Trying to explain to my 12 year old daughter why the local economy is weak and how money works. Little does she know that most of us adults can’t figure out how it works either.

People are not selling real estate and making commissions any more. People are not building houses and receiving weekly salaries. Since those people don’t have any money or have left town, they don’t buy as many lunches at the deli; they don’t buy a beer down at the brew pub.

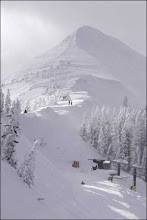

The deli workers have less money to spend at the local stores. The brew pub workers don’t have enough money to buy new jackets to ride the mountain this winter.

So, if you follow the trail of a dollar bill throughout Pagosa, it starts to slow down; it doesn’t move from as many hands to the next. The “speed of money” is slowing down in Pagosa.

Less money moving through our hands means we tighten our budgets and our belts. Town Hall has to slow down the number of capital improvement projects it can do. The County can forget about serious road improvements. Just about the only entity on the planet that can live without budgetary limitations is the federal government of the U.S.

The Federal Reserve can just print as many dollars as it needs on any given day. Of course, it is a lot more complicated than that but, then again, it really is that simple.

First confusing piece of trivia: the “Federal Reserve” is not part of the federal government. In 1913 our U.S. government decided to give away the power to “print money” to an elite group of bankers. To make it sound official, the bankers took on the name Federal Reserve. The Federal Reserve can print money. The Federal Reserve through the “fractional reserve” system allows banks to lend out their money several times over which creates a “money multiplier” of up to twelve times more money to lend out than the bank actually has.

However, the US government itself can create "money out of thin air” by borrowing money from other countries like China and Saudia Arabia. It works like this. The United States says, “you give me your stuff -- products and oil -- and we will give you green pieces of paper”. Those other countries end up with a whole lot of our green pieces of paper and we get the stuff.

Because the other “trade surplus” countries have so much of our green pieces of paper, they need a safe place to store it. Historically, a very safe way to store US dollars was to buy US Treasury notes. Essentially, the United States says “hey, look at all those green dollar bills. Let us borrow them and we’ll give you interest.”

So actually, we get the products and oil from other countries and they get a “promise” from us to get green pieces of paper “later”…….much later. Although sometimes politicians and economists say trade deficits are bad for our country, most of us have enjoyed getting all the stuff.

We get the stuff and they get a promise for lots of green pieces of paper sometime later. We get well over $1 billion of stuff every day this way.

Now, when the US government needs to actually pay up on a Treasury note, we can create (out of thin air) more green pieces of paper by selling somebody else more Treasury notes. Imagine that you are living off of credit cards and new credit cards keep coming in the mail, allowing you to pay off the old credit cards and even have additional dollars to spend. The only difference between the US government and the individual with credit cards is that, eventually, no one will send the individual any more credit cards.

It used to be that governments had to back up their money with gold bars sitting in a vault. But in 1971, Richard Nixon was able to tell the entire western world that currencies would no longer be backed up by gold. Instead, all western currencies became tied to the US dollar. Little green pieces of paper began to back up world currencies; not gold.

So, you can imagine how attached all the western governments are to making sure that the US dollar does not fail.

Second confusing piece of trivia: inflation. Everybody knows that “inflation” is caused by the cost of goods and services increasing. But that is not what inflation is. Actually, inflation is a “deflating” dollar. If both the Federal Reserve and the US government can “create money out of thin air” then it makes sense that, over time, a dollar bill will be worth less and less and that it will take more dollar bills to buy a bushel of wheat and a barrel of oil than it used to.

On average, a bar of gold will buy the same number of bushels of wheat that it did 2000 years ago. In other words, a bar of gold doesn’t experience inflation. Only a dollar bill (or other paper currency) experiences inflation.

Eventually, all paper currencies become worthless. (No, it is not different this time.)

If the United States borrows 100 billion dollars from Saudia Arabia at a time when a barrel of oil costs $100. and if later the United States pays back Saudia Arabia when a barrel of oil costs $200. then, effectively, the US has borrowed one billion barrels of oil but only has to give back half of what it borrowed. That sounds like a good deal for us, eh? In other words, the US government uses inflation to shrink its debt.

Wall Street has also been allowed to “create money out of thin air“. And, guess what, us folks on Main Street, USA have also been allowed to create money out of thin air. Think of it this way: since the Federal Reserve has wanted to “print” a lot more money to keep the system afloat, it makes sense that Wall Street and individual homeowners would be encouraged to help “create” the money.

The basic premise to the whole game is this. If one person holds on to a dollar bill all day, then it is only one dollar. But if, instead, that person spends her one dollar first thing in the morning, and then another person spends that same dollar, and then another person, etc………..by the end of the day, if ten people have spent that dollar bill, then the economy would feel the effects of ten new dollars of spending on that day. But the catch is that if the first person keeps the dollar in her pocket then there is zero dollars of spending on that day.

The “speed of money” is a gauge of how fast that dollar bill is moving from hand to hand and being spent.

Foreign countries now own about 25% of US government debt. Since foreign companies kept buying US debt and kept giving us their goods and services, the Federal Reserve has been able to keep interest rates low for us folks here at home. Lots of countries like China and Saudia Arabia were happy to loan us money because it was a safe place to store all of the US dollars they were earning selling us products and oil. In turn, the low interest rates made it easy for Wall Street and for Main Street to borrow money from the banking system.

Money was moving fast and this “money multiplier” effect has kept many here at home fat and happy. Unless you were on a fixed salary and inflation destroyed your buying power. The speed of money is also the speed at which "the rich get richer" and "the poor get poorer".

By using something called "derivatives" and other creative financing schemes, and by making commissions on the speed of money, Wall Street had been able to "create money" as well.

But what happens to the money multiplier party if foreign governments stop buying our debt and Main Street stops borrowing money to buy houses and goods and services? You get an incredibly fast shrinking of the effective money supply.

As the money supply contracts, the “lines of credit” shrink. Soon it becomes very difficult to borrow money and the effective money supply continues to shrink. People are unable to pay back their debt to the banks and then the banks start to fail.

I have read that there is a silent bank run going on. Large investment funds and corporations are very quietly emptying out their bank accounts because they don’t trust the banks to hold their money.

Tier 1 commercial (loan) paper is how many medium and large size businesses finance their day-to-day operations. I have read that the amount of commercial (loan) paper being issued is down 15% from last year and half of that drop occurred within the past few weeks. Very soon, businesses all across the country will be unable to run their businesses as usual.

So the federal government and the Federal Reserve and Wall Street can each, in their own way, create money out of thin air. But how have we the citizens on Main Street been able to create money out of thin air?

During the first five years of this new millenium, the excess cheap credit has allowed speculation in the real estate market. A buying frenzy occurred in real estate and prices shot through the roof. Individuals on Main Street have seen an enormous growth in the value of their homes and, therefore, have been able to borrow more and more money from banks only too eager to lend.

By pulling out cash from their increasingly more “expensive” houses, folks on Main Street have had a new source of cash that didn’t require any more work than filling out loan application forms. Folks on Main Street have helped fuel the growth of credit encouraged by the Federal Reserve and have bought increasingly higher levels of personal debt. They took the equity in their homes and bought other things. Although we all thought that we were some kind of smart investors, really this new found cash from our homes has turned out to be money created out of thin air.

All of these sources of “cheap” cash are what drove the huge real estate boom and construction boom in Pagosa Springs over the first five years of the new millenium.

What is happening today is the exact opposite. The speed of money has slowed way down. It is difficult to borrow money. The “speculators” have left Pagosa Springs. Some investors have left Pagosa Springs. Some young families who need jobs are leaving Pagosa Springs.

As we experience the exact opposite -- when the speed of money slows way down -- our local economy slowly begins to grind to a halt.

This is the purpose of the “bailout” plan being fought over in Washington D.C. Many politicians do not want the “money created out of thin air” party to end. Another name for a very slow speed of money nation-wide is “recession”.

Many of us in this country have become comfortable with an economy kept afloat by “money created out of thin air”. But, like a hot air balloon with no more propane, our local economy and the national economy are dropping from the sky.

People are not selling real estate and making commissions any more. People are not building houses and receiving weekly salaries. Since those people don’t have any money or have left town, they don’t buy as many lunches at the deli; they don’t buy a beer down at the brew pub.

The deli workers have less money to spend at the local stores. The brew pub workers don’t have enough money to buy new jackets to ride the mountain this winter.

So, if you follow the trail of a dollar bill throughout Pagosa, it starts to slow down; it doesn’t move from as many hands to the next. The “speed of money” is slowing down in Pagosa.

Less money moving through our hands means we tighten our budgets and our belts. Town Hall has to slow down the number of capital improvement projects it can do. The County can forget about serious road improvements. Just about the only entity on the planet that can live without budgetary limitations is the federal government of the U.S.

The Federal Reserve can just print as many dollars as it needs on any given day. Of course, it is a lot more complicated than that but, then again, it really is that simple.

First confusing piece of trivia: the “Federal Reserve” is not part of the federal government. In 1913 our U.S. government decided to give away the power to “print money” to an elite group of bankers. To make it sound official, the bankers took on the name Federal Reserve. The Federal Reserve can print money. The Federal Reserve through the “fractional reserve” system allows banks to lend out their money several times over which creates a “money multiplier” of up to twelve times more money to lend out than the bank actually has.

However, the US government itself can create "money out of thin air” by borrowing money from other countries like China and Saudia Arabia. It works like this. The United States says, “you give me your stuff -- products and oil -- and we will give you green pieces of paper”. Those other countries end up with a whole lot of our green pieces of paper and we get the stuff.

Because the other “trade surplus” countries have so much of our green pieces of paper, they need a safe place to store it. Historically, a very safe way to store US dollars was to buy US Treasury notes. Essentially, the United States says “hey, look at all those green dollar bills. Let us borrow them and we’ll give you interest.”

So actually, we get the products and oil from other countries and they get a “promise” from us to get green pieces of paper “later”…….much later. Although sometimes politicians and economists say trade deficits are bad for our country, most of us have enjoyed getting all the stuff.

We get the stuff and they get a promise for lots of green pieces of paper sometime later. We get well over $1 billion of stuff every day this way.

Now, when the US government needs to actually pay up on a Treasury note, we can create (out of thin air) more green pieces of paper by selling somebody else more Treasury notes. Imagine that you are living off of credit cards and new credit cards keep coming in the mail, allowing you to pay off the old credit cards and even have additional dollars to spend. The only difference between the US government and the individual with credit cards is that, eventually, no one will send the individual any more credit cards.

It used to be that governments had to back up their money with gold bars sitting in a vault. But in 1971, Richard Nixon was able to tell the entire western world that currencies would no longer be backed up by gold. Instead, all western currencies became tied to the US dollar. Little green pieces of paper began to back up world currencies; not gold.

So, you can imagine how attached all the western governments are to making sure that the US dollar does not fail.

Second confusing piece of trivia: inflation. Everybody knows that “inflation” is caused by the cost of goods and services increasing. But that is not what inflation is. Actually, inflation is a “deflating” dollar. If both the Federal Reserve and the US government can “create money out of thin air” then it makes sense that, over time, a dollar bill will be worth less and less and that it will take more dollar bills to buy a bushel of wheat and a barrel of oil than it used to.

On average, a bar of gold will buy the same number of bushels of wheat that it did 2000 years ago. In other words, a bar of gold doesn’t experience inflation. Only a dollar bill (or other paper currency) experiences inflation.

Eventually, all paper currencies become worthless. (No, it is not different this time.)

If the United States borrows 100 billion dollars from Saudia Arabia at a time when a barrel of oil costs $100. and if later the United States pays back Saudia Arabia when a barrel of oil costs $200. then, effectively, the US has borrowed one billion barrels of oil but only has to give back half of what it borrowed. That sounds like a good deal for us, eh? In other words, the US government uses inflation to shrink its debt.

Wall Street has also been allowed to “create money out of thin air“. And, guess what, us folks on Main Street, USA have also been allowed to create money out of thin air. Think of it this way: since the Federal Reserve has wanted to “print” a lot more money to keep the system afloat, it makes sense that Wall Street and individual homeowners would be encouraged to help “create” the money.

The basic premise to the whole game is this. If one person holds on to a dollar bill all day, then it is only one dollar. But if, instead, that person spends her one dollar first thing in the morning, and then another person spends that same dollar, and then another person, etc………..by the end of the day, if ten people have spent that dollar bill, then the economy would feel the effects of ten new dollars of spending on that day. But the catch is that if the first person keeps the dollar in her pocket then there is zero dollars of spending on that day.

The “speed of money” is a gauge of how fast that dollar bill is moving from hand to hand and being spent.

Foreign countries now own about 25% of US government debt. Since foreign companies kept buying US debt and kept giving us their goods and services, the Federal Reserve has been able to keep interest rates low for us folks here at home. Lots of countries like China and Saudia Arabia were happy to loan us money because it was a safe place to store all of the US dollars they were earning selling us products and oil. In turn, the low interest rates made it easy for Wall Street and for Main Street to borrow money from the banking system.

Money was moving fast and this “money multiplier” effect has kept many here at home fat and happy. Unless you were on a fixed salary and inflation destroyed your buying power. The speed of money is also the speed at which "the rich get richer" and "the poor get poorer".

By using something called "derivatives" and other creative financing schemes, and by making commissions on the speed of money, Wall Street had been able to "create money" as well.

But what happens to the money multiplier party if foreign governments stop buying our debt and Main Street stops borrowing money to buy houses and goods and services? You get an incredibly fast shrinking of the effective money supply.

As the money supply contracts, the “lines of credit” shrink. Soon it becomes very difficult to borrow money and the effective money supply continues to shrink. People are unable to pay back their debt to the banks and then the banks start to fail.

I have read that there is a silent bank run going on. Large investment funds and corporations are very quietly emptying out their bank accounts because they don’t trust the banks to hold their money.

Tier 1 commercial (loan) paper is how many medium and large size businesses finance their day-to-day operations. I have read that the amount of commercial (loan) paper being issued is down 15% from last year and half of that drop occurred within the past few weeks. Very soon, businesses all across the country will be unable to run their businesses as usual.

So the federal government and the Federal Reserve and Wall Street can each, in their own way, create money out of thin air. But how have we the citizens on Main Street been able to create money out of thin air?

During the first five years of this new millenium, the excess cheap credit has allowed speculation in the real estate market. A buying frenzy occurred in real estate and prices shot through the roof. Individuals on Main Street have seen an enormous growth in the value of their homes and, therefore, have been able to borrow more and more money from banks only too eager to lend.

By pulling out cash from their increasingly more “expensive” houses, folks on Main Street have had a new source of cash that didn’t require any more work than filling out loan application forms. Folks on Main Street have helped fuel the growth of credit encouraged by the Federal Reserve and have bought increasingly higher levels of personal debt. They took the equity in their homes and bought other things. Although we all thought that we were some kind of smart investors, really this new found cash from our homes has turned out to be money created out of thin air.

All of these sources of “cheap” cash are what drove the huge real estate boom and construction boom in Pagosa Springs over the first five years of the new millenium.

What is happening today is the exact opposite. The speed of money has slowed way down. It is difficult to borrow money. The “speculators” have left Pagosa Springs. Some investors have left Pagosa Springs. Some young families who need jobs are leaving Pagosa Springs.

As we experience the exact opposite -- when the speed of money slows way down -- our local economy slowly begins to grind to a halt.

This is the purpose of the “bailout” plan being fought over in Washington D.C. Many politicians do not want the “money created out of thin air” party to end. Another name for a very slow speed of money nation-wide is “recession”.

Many of us in this country have become comfortable with an economy kept afloat by “money created out of thin air”. But, like a hot air balloon with no more propane, our local economy and the national economy are dropping from the sky.